|

Guppy and Darvas Combo modules - how they

work together in OmniTrader |

|

This duo strategy is a combination of a breakout via Darvas and a confirmation of

trend via Guppy. |

|

The conditions which need to be satisfied to go

long on a breakout trend up

are..

-

[Slide 1] The share has to break out via Darvas Box first and The Gams Osc at the bottom – has to be green at

the same time - meaning it has passed the filter –

so even if blue moving average line (traders) is above red moving

average line (investors) this filter has to be passed before a

signal fires as well. [The Gams Osc is the test which checks for the guppy

moving averages]. The vote line only fires when all conditions are

met at the same time - if Darvas did not fire then this strategy

will not fire

-

[Slide 2] Each strategy has a series of

tests which is must pass

-

[Slide 3] The three related Guppy and

Darvas strategies use

multiple systems to determine if the vote should be fired (of course

you can use each strategy in isolation if you wish)

|

|

Slide 1 - showing FMG with Guppy-Darvas strategy - the signal has fired on break out of the

Darvas Box and Gams test has also passed |

|

|

|

|

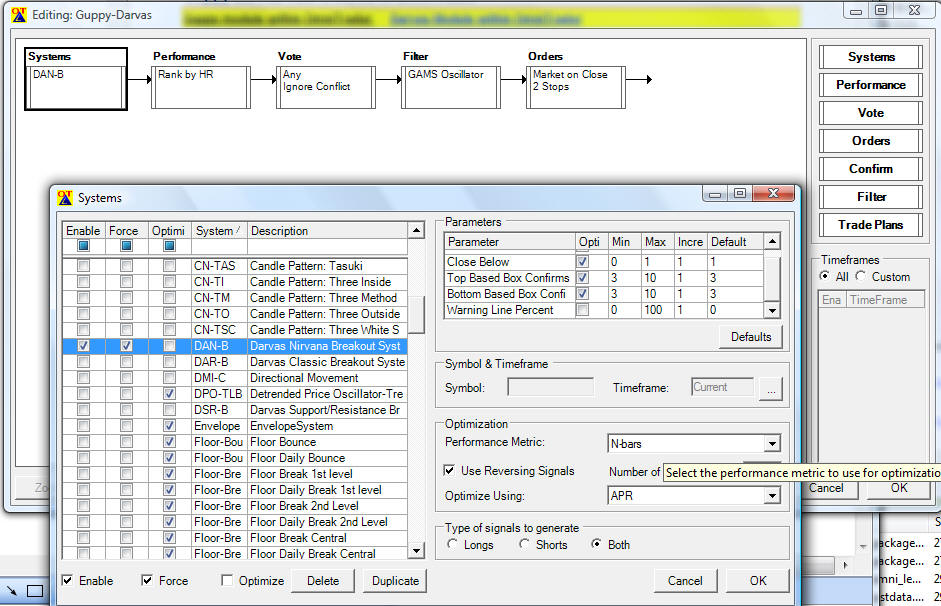

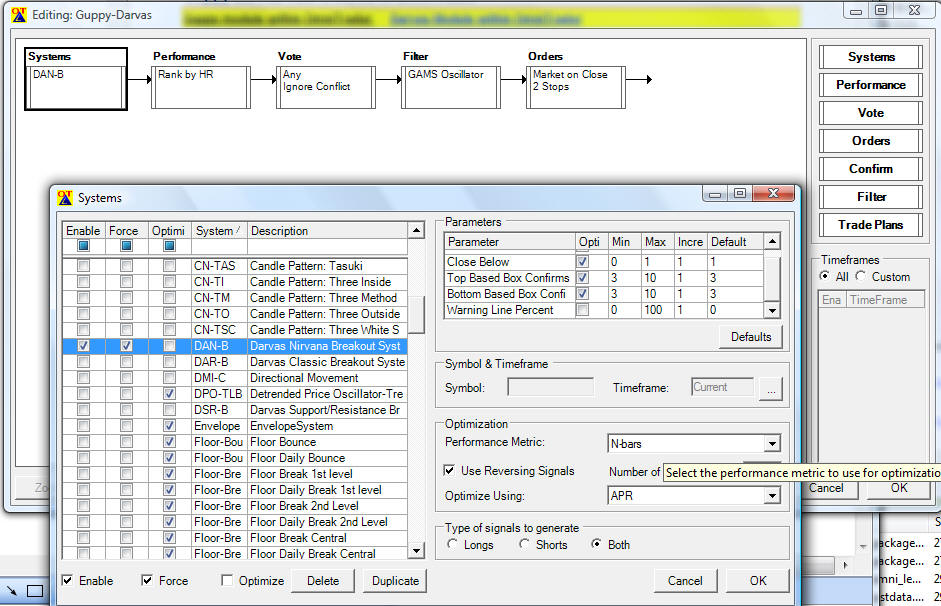

Slide 2 - The Strategy Module - determines how the systems are

voted - each signal is run via series of tests and filters to

determine if an order is placed - here is part of the

module which you can view and edit - this shows just the systems part of

the Guppy-Darvas strategy module |

|

Note that you can set the option to fire buys/longs only |

|

|

|

|

Slide 3- The following vote line example is for PDN - it show 3

different but related strategies - Darvas, GMMA, and the Guppy-Darvas

combo (all are activated) - you will note that the votes are firing at

different times. This is because each strategy is using a different set

of trading systems. Each can be examined as shown in the above slide.

|

|

As user it is important that you decide which strategy is the most

profitable for

you - this is often done by using back

testing or the

hot strategy

finder module |

|

Learn more about which strategy to

select |

|

|

|