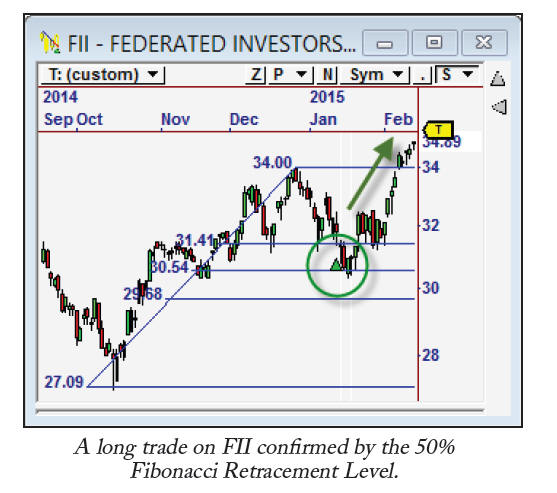

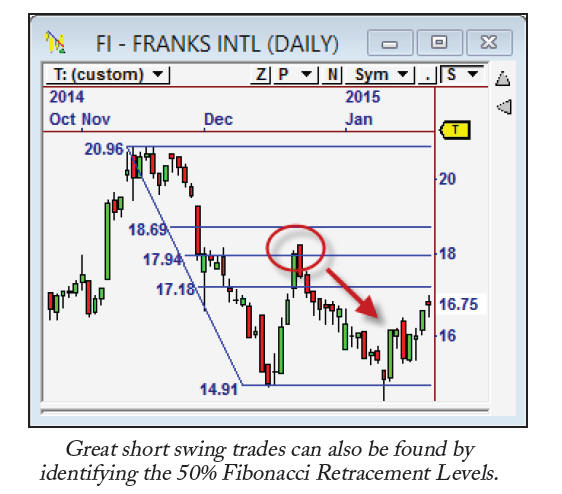

Fibonacci Levels are measured from the most recent high pivot to the most recent major low pivot (or vice versa). The levels represent the percentage distance within this measured range. The three most popular levels are the 38%, 50%, and 62% Levels. But the main Fib Retracement Level is the 50% Level.

The 50% Retracement Level is of course halfway between these major pivots. This mark is a common profit taking level for traders. For traders looking to take a trade in the direction of the previous trend, this can also present a value buy due to the extensive pullback. These are just two of the logical reasons that we often see a reaction when price tests the 50% level.

For swing trades, the 50% retracement level provides excellent confirmation. The retracement reaction frequently adds to the momentum that is inherent in the reversion move. Remember, we donít need price to retrace all the way back to the major pivot. We just need a slight move in our favour, and confirming with the 50% Fibonacci Retracement Level is a great way to get that move.