| Signals Generated |

|

Users can change the default option which is to generate all long and

short opportunities to the vote line. There are two options. |

|

|

|

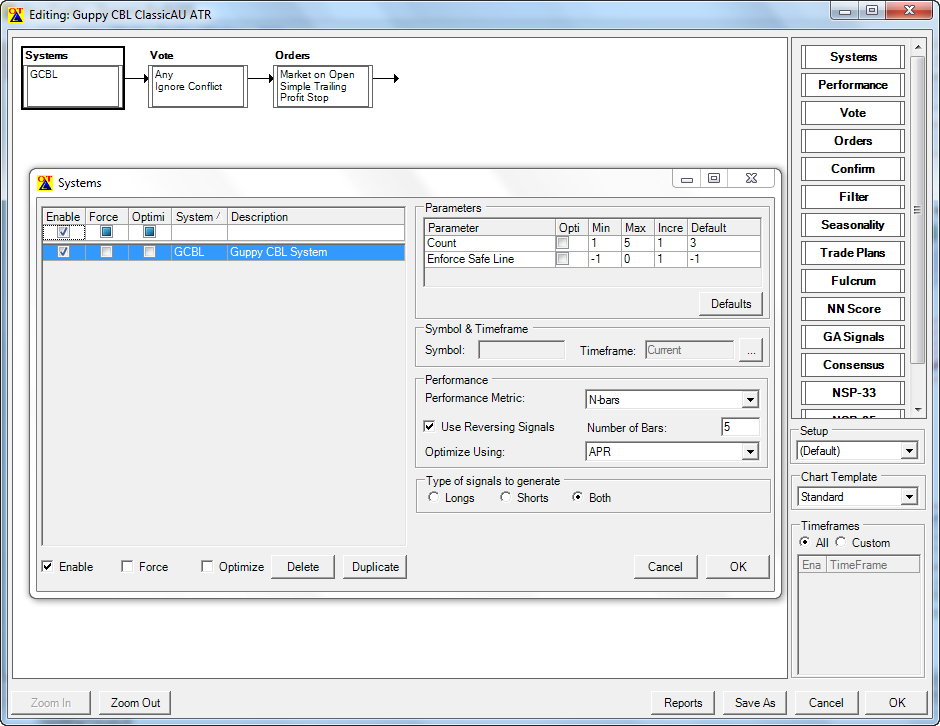

OmniTrader can scan for opportunities to go Long or short -

this is determined in the strategy SYSTEMS block here. This example is

the Guppy Strategy module. The systems block in this case is a Guppy CBL

(count back line) strategy using a modified ATR exit rule. Note the type

of signal to generate box. Here we have selected to generate all signals |

|

|

|

|

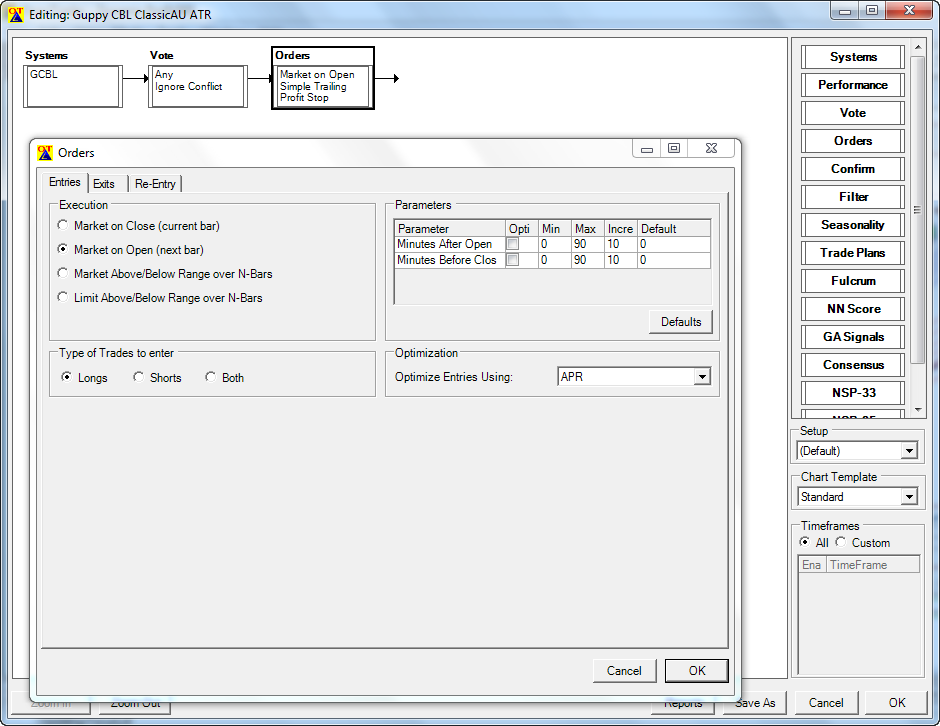

Additionally a user can determine whether they are interested in

seeing both long and short signals generated to the vote line by y using

the strategy ORDERS block here. This the part of the strategy which

places orders into the vote line. So for example if you are only

interested in going long you would set the option here |

|

|

|

|

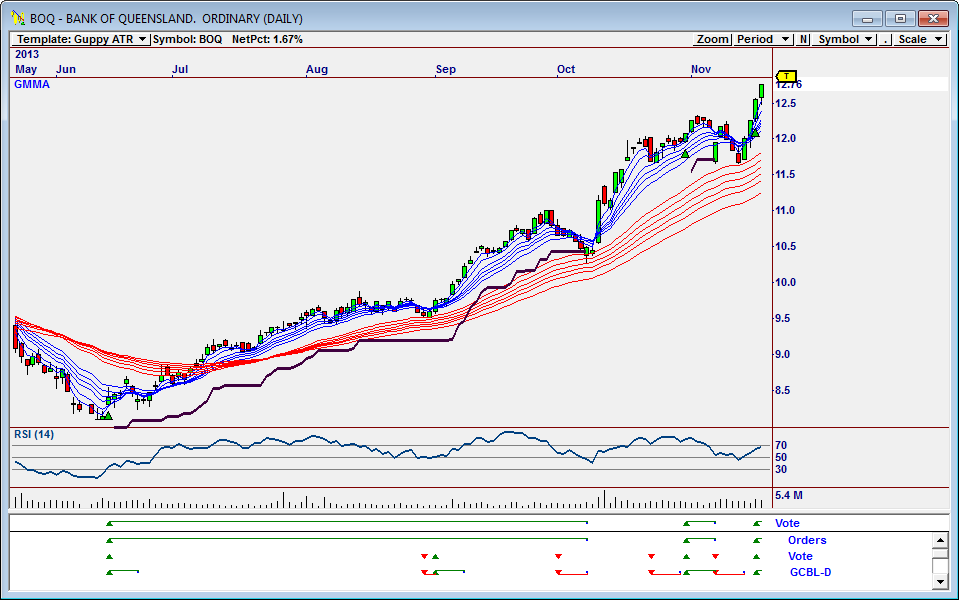

The following is an example of the outcome of the above set up. Note

that only long signals show in the vote line, however the strategy does

generate short signals - foe example see the October short signal. Also

note in the chart the trailing stop loss built into the strategy is

displayed. |

|

|

|

|

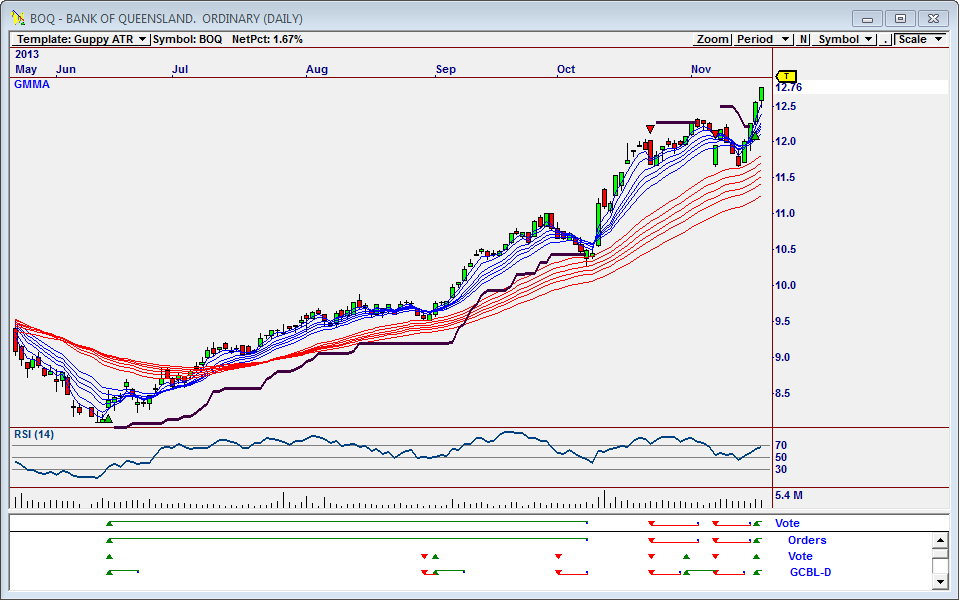

Following is the same chart this time we have allowed shorts to show

- note the shorts in late October and November now show up |

|