| Use of Filters |

|

Sometimes it is useful to add a filter to reduce or modify the number

of signals that a strategy generates. |

|

This can be done by modifying your strategy. The following shows an

example, using the GUPPY multiple moving average strategy ( but this

could be any strategy). |

|

The objective is this case was to stop any signals which fire form the

strategy when the current share price is below a 20 day moving average

share price. The reason for this idea is that we only want to take votes

on up trending shares. |

|

|

|

To learn on how filters work go Help, Content and search for

Filter also search for Trading strategies |

|

You can also review the

tutorial seminar

on trading strategies which came with the software |

|

For further education watch a detailed 14 minute video on creating

filters - this is part of a longer seminar - download this to watch |

|

|

|

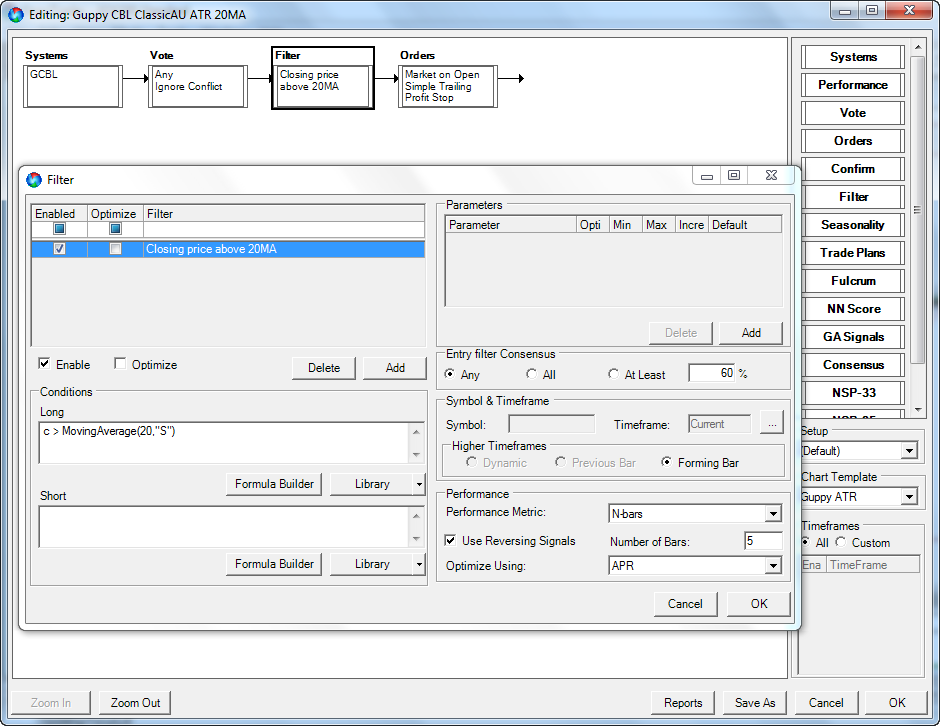

Here is the strategy block with the filter added. Once done the

strategy is saved with a new name. Only long filter entered since the

strategy is only searching for long opportunities, if shorts were to be

scanned then a short filter would be entered ( same but reversed) |

|

|

|

|

Here is the Vote line outcome showing the modified and unmodified

strategies - we have added to the chart a 20 moving average to highlight

the filter at work. The modified strategy vote line is the bottom vote

line and it shows how signals have been filtered |

|

|

|

|

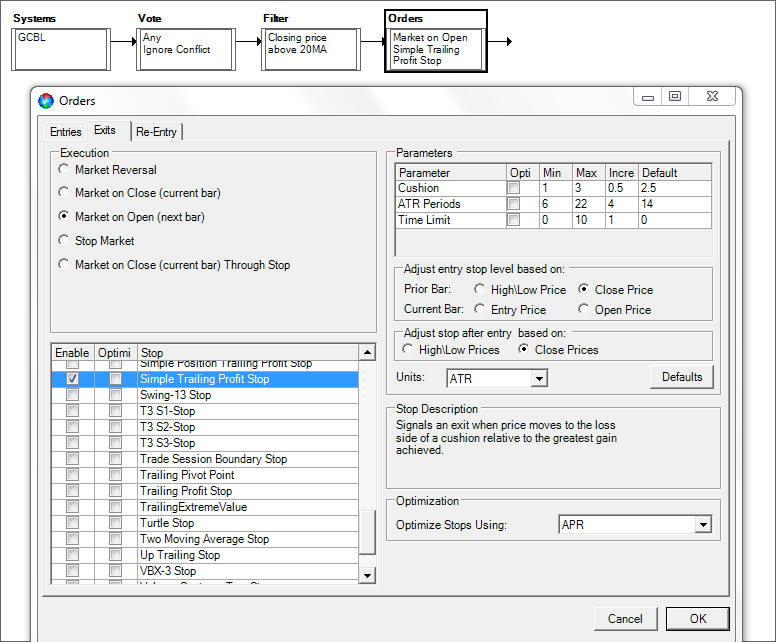

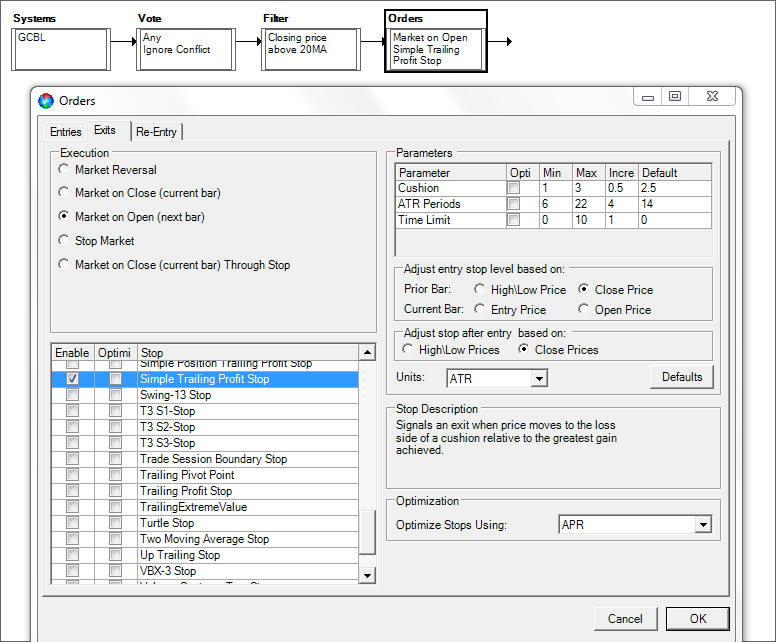

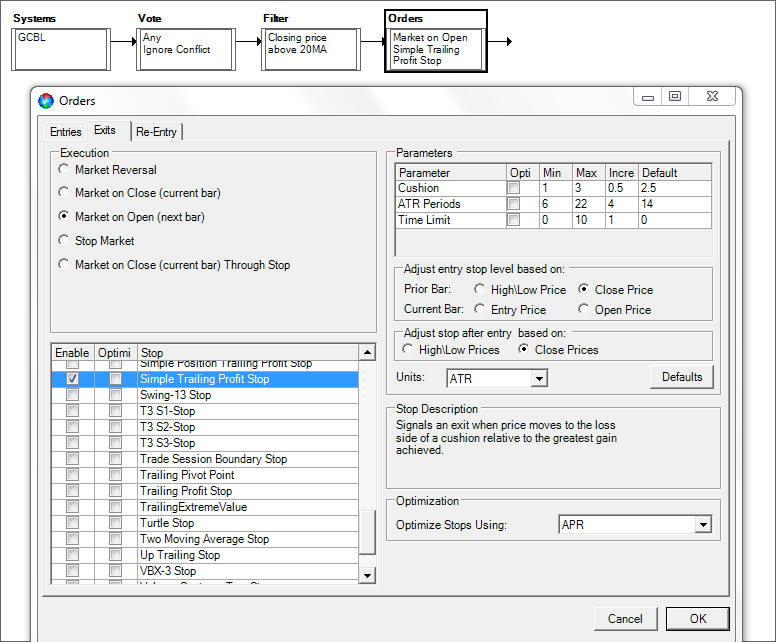

For those interested here is the Orders Block with a modified exit -

a simple trailing stop 2.5 ATR |

|