- With market uncertainty you should use the software to provide guidance for your decisions

- You should scan for shares to buy and more importantly understand what not to buy

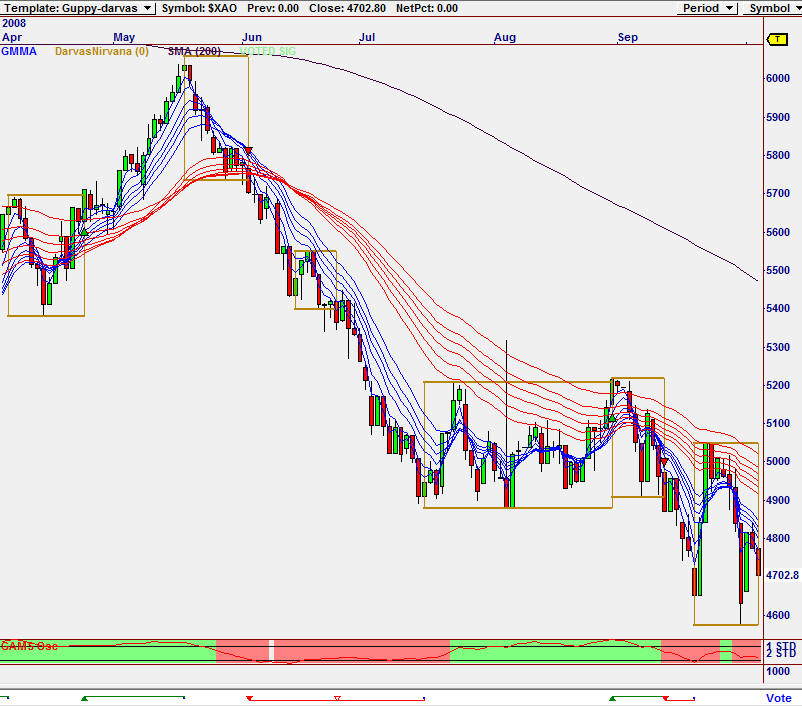

- The most popular add-on strategy module is the Guppy module (multiple moving averages) + Darvas Module (support-resistance breakout strategy module) since together they find trending breakout opportunities click here for more info

- In addition we now have a wave trending module to provide additional confirmation and guidance click here for details

- The simple rule for this Guppy-Darvas strategy (shown in the examples below) is to buy when the the blue lines break out over the red after a Darvas box has been established. Click here for more details

- Lets look at some current examples - observe the vote lines at the bottom of the charts for the signals

- Note: not all shares suffer the same fate as the overall market in these examples

- In the current market all positions need to be watched on a daily basis. No longer can a portfolio be reviewed each month.