| VBX-3 Trading System |

|

|

|

|

|

|

|

| The VBX-3 Trading Strategy |

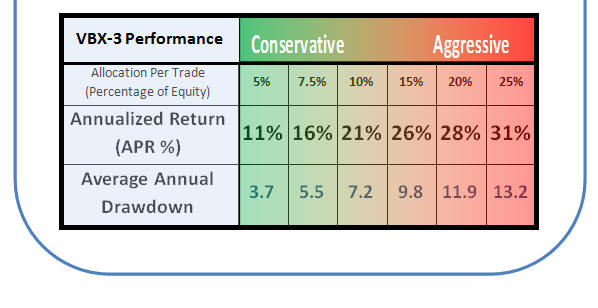

| The VBX-3 Trading Strategy is based on the reversion to mean concept. This type of trading opportunity looks to trade a security when it makes a significant move away from the direction of the primary trend. Profits are realized when the security reverts back to the mean. These trades are highly accurate and provide excellent swing trading opportunities. Due to the trade management provided by the VBX-3 strategy, the typical VBX-3 trade lasts about three days. |

| The VBX-3 Trade Plan |

| VBX-3 includes the VBX-3 Trade Plan for trade management. A Fixed Loss Stop is used to control per trade risk while the VBX-3 Stop is used as a dynamic profit target. The VBX-3 Stop is relatively tight and the average length of a VBX-3 trade is about 3 days. Both of these stops use a Market on Open order type. This makes it very easy to trade strategy in just minutes a day. |

|

| To review Australian Test results |